Aadhar Card Status कैसे चेक करें?

आधार केंद्र से सफलतापूर्वक आवेदन करने के पश्चात आप अपना आधार कार्ड का स्टेटस चेक (Aadhar Card Status) ऑनलाइन ऑफलाइन दोनों तरीके से कर सकते हैं इसके लिए आपको आधार केंद्र से मिली रसीद की जरूरत होगी।

How to Check Aadhar Card Status

Uidai की आधिकारिक वेबसाइट पर जाकर आवेदक अपना आधार कार्ड का स्टेटस चेक कर सकते हैं इसके लिए यूआइडीएआइ की ऑफिशल गाइडलाइन के अनुसार किसी भी शुल्क नहीं लिया जाता है तथा आप निम्नलिखित स्टेप्स को फॉलो करके आसानी से अपने आधार कार्ड का स्टेटस (Aadhar Card Status) चेक कर सकते हैं

- Step 1- सर्वप्रथम आप यूआइडीएआइ की ऑफिशल वेबसाइट पर जाना होगा https://myaadhaar.uidai.gov.in/CheckAadhaarStatus

- Step 2- यहां पर आपको चेक आधार स्टेटस Check Aadhaar Update Status पर क्लिक करना है

- Step 3- यहां पर आपको आधार कार्ड स्टेटस चेक करने के लिए रसीद में दिए गए एनरोलमेंट नंबर एवं कैप्चा को इंटर कर सबमिट बटन पर क्लिक करें अगली विंडो में आपका आधार कार्ड का स्टेटस (Aadhar Card Status) आप देख पाएंगे

- अगले पेज पर आपको अपने आधार कार्ड के का स्टेटस स्क्रीन पर प्रदर्शित हो जाएगा तथा आधार कार्ड में कोई भी संशोधन हो तो आप नजदीकी आधार कार्ड केंद्र पर जाकर आधार कार्ड करेक्शन के लिए आवेदन कर सकते हैं

Check Aadhaar update status

अगर आपके द्वारा आधार कार्ड में किसी भी तरह का अपडेट जैसे की अपने पता नाम जन्मतिथि पिता का नाम आदि करवाया गया है तब भी आप इस पोस्ट में ऊपर बताए गए तरीके से अपने आधार कार्ड के स्टेटस (Aadhar Card Status) का पता कर सकते हैं

एनरोलमेंट नंबर के बिना आधार कार्ड का स्टेटस जानने का तरीका

अगर आपके द्वारा आधार केंद्र से मिला एनरोलमेंट नंबर भूल गए हैं या एनरोलमेंट नंबर की स्लिप हो गई है तब भी आप बिना एनरोलमेंट नंबर के निम्न स्टेप की सहायता से अपने आधार कार्ड का स्टेटस चेक कर सकते हैं बिना एनरोलमेंट नंबर के आधार कार्ड एप्लीकेशन का स्टेटस चेक करें-

- आप अपना एनरोलमेंट नंबर दोबारा पाने के लिए आधिकारिक वेबसाइट पर क्लिक करें https://myaadhaar.uidai.gov.in/retrieve-eid-uid

- अपने एनरोलमेंट नंबर की जानकारी पाने के लिए EID or UID (Aadhaar) विकल्प को चुने

- यहां पर आप अपने रजिस्टर्ड मोबाइल नंबर के द्वारा ओटीपी के माध्यम से एवं सिक्योरिटी कोड डाल करके लॉगिन करें

- दिए के कॉलम में संदेश के माध्यम से प्राप्त ओटीपी को डालें एवं वेरीफाई ओटीपी पर क्लिक करें

- एक बार वेरीफाई होने के बाद आपका एनरोलमेंट नंबर आवेदन के द्वारा दी गई ईमेल आईडी और मोबाइल नंबर पर भेज दिया जाता है

- इस एनरोलमेंट नंबर का इस्तेमाल करके इस पोस्ट में ऊपर बताए गए तरीके से आप अपना आधार कार्ड का स्टेटस (Aadhar Card Status) आसानी से देख सकते हैं|

Aadhaar PVC Card Order Status Check

UIDAI के द्वारा आधार कार्ड धारकों को एक विशेष सुविधा उपलब्ध कराई गई है इसके अंदर आप ऑनलाइन UIDAI के वेबसाइट पर आधार कार्ड पीवीसी कार्ड की फॉर्म में अपने पते पर मंगवा सकते हैं आधार कार्ड में बताएं पते पर पीवीसी आधार कार्ड की डिलीवरी आमतौर पर 15 दिवस के समय में हो जाती है नीचे दिए गए स्टेप्स को फॉलो करके आप अपने आधार पीवीसी कार्ड ऑर्डर का स्टेटस चेक (Aadhar Card Status) कर सकते हैं

- स्टेप 1: आप सीधी ही UIDAI के वेबसाइट पर क्लिक करें सीधे https://myaadhaar.uidai.gov.in/checkStatus पर जाएं।

- स्टेप 2: आप अपना एनरोलमेंट नंबर और कैप्चा कोड डाल करके SUMIT करें।

- स्टेप 3: आपके Aadhaar PVC Card ऑर्डर अनुरोध का स्टेटस दिख जाएगा।

e-Aadhaar Card Download कैसे करें?

ई आधार कार्ड डाउनलोड करने के लिए आप आप आधिकारिक वेबसाइट पर जाकर अपने मोबाइल नंबर पर प्राप्त ओटीपी के माध्यम से लॉगिन कर आसानी से ई आधार कार्ड डाउनलोड कर सकते हैं नीचे दिए गए विभिन्न चरणों को फॉलो करके आप ई आधार कार्ड डाउनलोड कर सकते हैं|

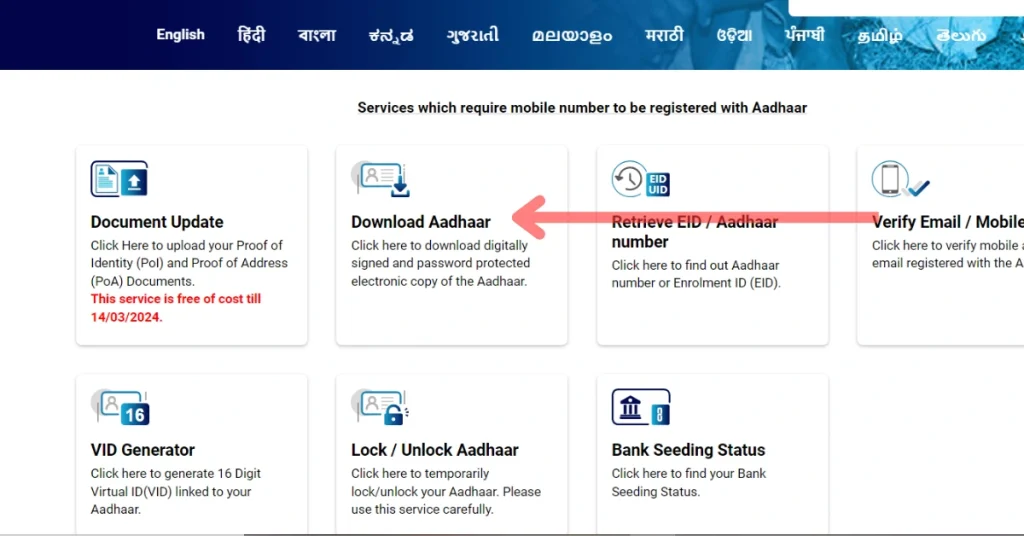

- सर्वप्रथम आपको आधिकारिक वेबसाइट https://myaadhaar.uidai.gov.in/ पर जाना होगा

- यहां पर आपको डाउनलोड आधार कार्ड पर क्लिक करना होगा

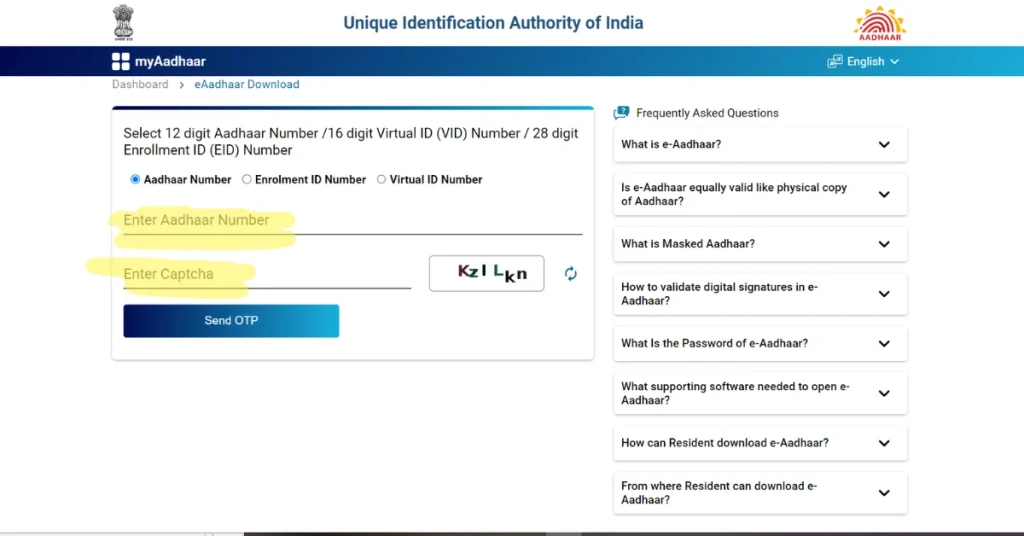

- इस पेज पर आपको अपना आधार कार्ड नंबर एवं प्रदर्शित हो रहा कैप्चा संबंधित कॉलम में इंटर करना होगा तत्पश्चात सेंड ओटीपी पर क्लिक करें

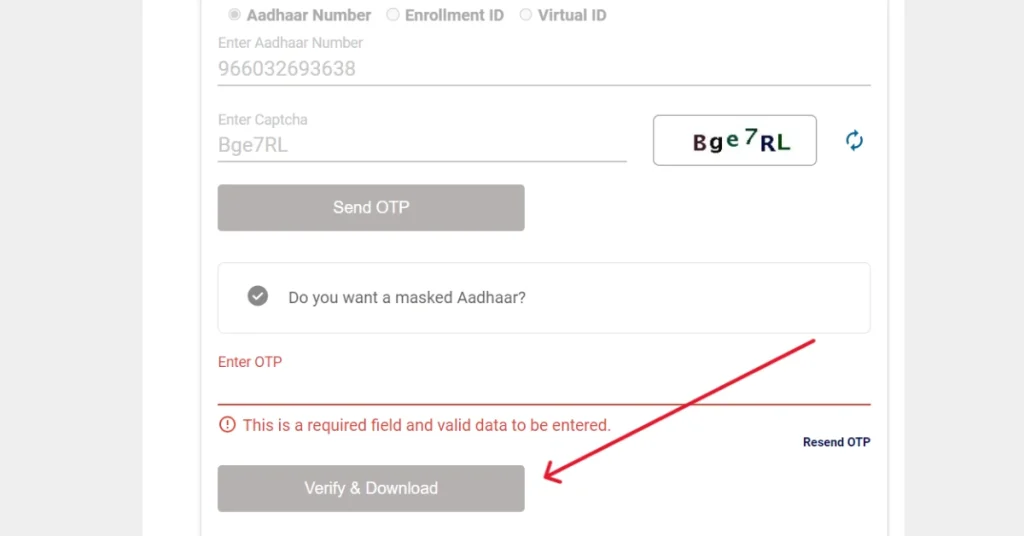

- ओटीपी आपका आधार कार्ड में रजिस्टर्ड मोबाइल नंबर पर UIDAI की तरफ से भेजा जाएगा ओटीपी संबंधित कॉलम पेज में आपको इंटर करना होगा

- उसके बाद Verify & Download पर क्लिक करने के पश्चात आपके फोन में एक आधार कार्डफाइल डाउनलोड हो जाएगी

- यह आधार कार्ड फाइल एक पासवर्ड प्रोटेक्टेड फाइल होगी इसे ओपन करने के लिए आपको ई आधार कार्ड पासवर्ड (E-Aadhar password) दर्ज करना होगा

- ई आधार पासवर्ड आधार कार्ड की जानकारी को सुरक्षित करने की एक महत्वपूर्ण प्रक्रिया है जिसके माध्यम से कोई भी आसानी से किसी दूसरे व्यक्ति की व्यक्तिगत जानकारी को प्राप्त नहीं कर सकता है

E-Aadhar क्या है?

e-Aadhar Card एक आधार कार्ड की सुरक्षित इलेक्ट्रॉनिक कॉपी है जो पीएफ पीडीएफ फाइल के रूप में आप UIDAI की आधिकारिक वेबसाइट से डाउनलोड कर सकते हैं PDF आधार कार्ड की कॉपी पर के सक्षम अधिकारी द्वारा डिजिटल रूप से हस्ताक्षर किया जाता है

ये भी पढ़ें:

इस पोस्ट के माध्यम से दी गई जानकारी (Aadhar Card Status)

मैं अपना आधार कार्ड स्थिति कैसे जांच सकता हूं?

आप अपने आधार कार्ड का स्टेटस जानने के लिए आधिकारिक आधार वेबसाइट पर जाकर “आधार स्थिति” या “Aadhar Card Status” विकल्प का उपयोग कर सकते हैं।

आधार अपडेट के लिए कितने दिन लगेंगे?

आधार अपडेट की प्रक्रिया में लगने वाला समय आपका आधार में अपडेट किए जाने वाला डाटा के प्रकार पर निर्भर करता है आमतौर पर, अपडेट प्रक्रिया कुछ सप्ताहों तक ले सकती है।

मैं अपने आधार कार्ड की स्थिति को नामांकन संख्या द्वारा कैसे ट्रैक कर सकता हूं?

आप अपने आधार कार्ड की नामांकन स्थिति को एनरोलमेंट नंबर की सहायता से यूआइडीएआइ की आधिकारिक वेबसाइट पर जाकर “Check Status by Enrollment Number” (नामांकन संख्या के द्वारा स्थिति जांचें) विकल्प का उपयोग कर सकते हैं।

what is urn number in Aadhar card status ?

The URN (Update Request Number) is a 14-digit number issued to individuals when they apply to change/update in Aadhar Card details.

how to check my Aadhar card status ?

visit the Official Uidai Website https://uidai.gov.in/ and Enter your Enrolment ID from your enrolment/update acknowledgement slip and captcha then click on “Check Status”